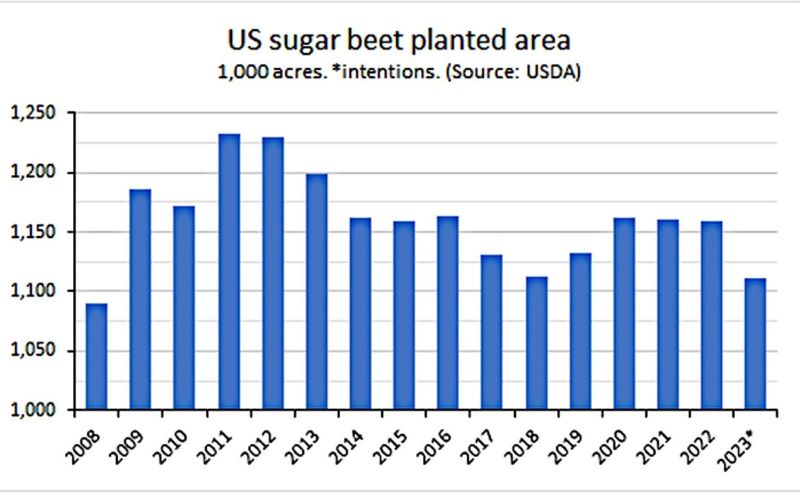

The US Department of Agriculture in its March 31 Prospective Plantings report said farmers intend to plant 1,110,800 acres to sugar beets in 2023, down 4.2% from 1,159,500 acres in 2022 and the lowest since 2008.

Planted area in Montana, typically the sixth largest beet planting state, was forecast at 24,000 acres, down 29% from 2022 and the lowest on record. Wyoming replaced Montana as the sixth major sugar beet growing state.

The drop in Montana was expected after the closing of the Sidney Sugars Co. Inc. beet processing plant was announced by the American Crystal Sugar Co. a few weeks ago. Growers (who aren’t part of a cooperative in the Sidney area as are growers in most other sugar beet areas) had indicated they would plant 19,500 acres to sugar beets this year, not enough to keep the Sidney plant running efficiently. Some of those lost acres appear to have been picked up by growers in Nebraska and Wyoming.

Perhaps the greatest sugar beet surprise in the report was North Dakota, the nation’s second-largest beet growing state, in which the USDA said farmers intend to plant 214,000 acres of beets, down 15% from 2022. Ideas that American Crystal growers in the Red River Valley may pick up some of the lost acres in Montana doesn’t appear to be the case.

Instead, it appears beet acres, along with acres intended for spring wheat other than durum, oats and barley in North Dakota lost out to other crops deemed more profitable by farmers. Large acreage increases in the state are expected for durum wheat, corn, soybeans and canola.

The drop in sugar beet planted area, and subsequent drop in 2023-24 domestic beet sugar production, comes at a time when sugar prices are in their second year of historically high levels, top import source Mexico is facing drought-reduced production, world sugar supplies are tightening and raw and refined sugar futures are at 10-plus year highs.

Recent gains in crude oil prices may tighten global sugar supplies even more as mills potentially may divert more of the cane crush in Brazil to cane-based ethanol, which to date has been less profitable than producing sugar for export.

Further, in the United States there are concerns that cold, wet weather in the Upper Midwest may delay sugar beet planting, which could reduce the “early” sugar beet harvest before the start of the new marketing year on Oct. 1, tightening sugar supplies in the current season.

Source : Baking Business